Europe’s Football Giants Redefine Financial Power Despite Growing Risks

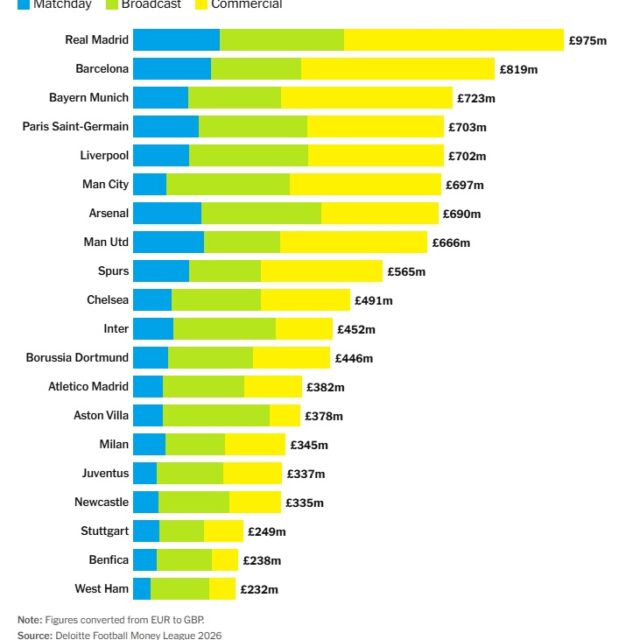

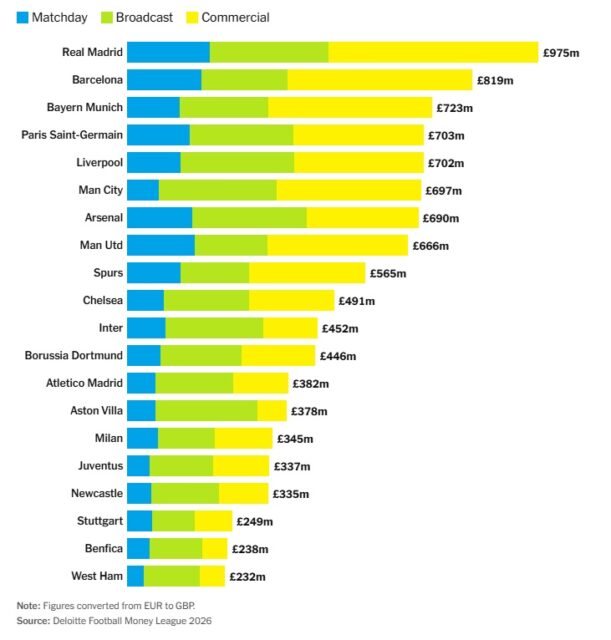

Spanish football once again set the benchmark for financial dominance in the global game. According to the latest edition of the Deloitte Football Money League, Real Madrid and FC Barcelona emerged as the two highest-earning clubs in world football for the 2024–25 season, underlining the shifting balance of economic power in the sport.

Real Madrid claimed top spot for the third consecutive year and for the 15th time overall since the report’s inception, generating a staggering £975 million in revenue. That figure placed them more than £150 million ahead of Barcelona, whose dramatic rise from sixth to second highlights the scale of their commercial recovery.

English clubs lose their grip on the top four

While English football remains commercially strong, this season marked a historic turning point. For the first time in the 29-year history of the Money League, no Premier League club featured in the top four. Even Liverpool, who surpassed £700 million in annual revenue during a title-winning domestic campaign, finished only fifth globally.

This shift reflects a broader trend. For much of the modern era, broadcast income—particularly from English television deals—has been the main driver of football revenues. However, that dominance is gradually being challenged.

Commercial income now leads the way

For the third season in a row, commercial revenue has become the largest income stream for the world’s top clubs. Across the top 20, commercial earnings reached £4.46 billion, an increase of £261 million year on year. Notably, the vast majority of that growth came from the already-elite clubs, reinforcing the widening financial gap within the game.

Real Madrid led this category by a considerable margin, generating nearly £500 million from commercial activities alone. Barcelona followed with £438 million, making them the only two clubs to exceed the £400 million threshold. Bayern Munich, Manchester City, Manchester United, Paris Saint-Germain and Liverpool also crossed the £300 million mark, while several clubs lower down the ranking failed to reach £100 million.

Revenue growth does not guarantee profitability

Despite the headline figures, Deloitte’s report offers a reminder that high income does not automatically translate into financial health. Of the clubs that published full accounts for the season, several still recorded pre-tax losses.

Barcelona provide a clear example. Despite generating over £800 million in revenue, the club ended the year with a modest deficit. A portion of their income came from one-off transactions, including long-term seat license sales at the refurbished Camp Nou—revenues that cannot be repeated in future seasons.

Deloitte’s analysis focuses strictly on revenue, meaning it does not fully account for operational costs, debt servicing, or long-term financial sustainability. As a result, inclusion in the ranking should not be mistaken for overall economic stability.

Broadcast income remains crucial—but volatile

Although commercial income now leads, broadcast revenue continues to play a decisive role, particularly for clubs whose success is closely tied to on-field performance. Real Madrid once again topped broadcast earnings, followed closely by Manchester City, Arsenal and Liverpool.

The expanded Champions League format and FIFA’s revamped Club World Cup also provided short-term boosts for several clubs. However, these windfalls are not guaranteed in future seasons, increasing financial vulnerability for teams heavily reliant on prize money and television income.

Signs of improved cost control at the elite level

One of the more positive signals from the report is improved wage discipline. Most clubs reduced their wage-to-revenue ratios, helped by rising incomes and the introduction of UEFA’s squad cost regulations. Combined wages among the top clubs remained broadly stable, even as overall revenues surpassed £10 billion for the first time.

Nevertheless, disparities remain. Paris Saint-Germain still fielded the most expensive squad in European football, while English clubs continued to account for the highest salary spending overall.

A changing financial landscape

The 2024–25 Deloitte Football Money League highlights a football economy in transition. Spanish clubs are strengthening their commercial dominance, English teams are facing stiffer competition at the top, and rising revenues are increasingly accompanied by financial caution rather than unchecked spending.

Record-breaking income may grab attention, but as the report makes clear, it is only one part of a far more complex financial picture—one where sustainability, cost control and competitive balance are becoming just as important as raw revenue figures.

Share this article

Trending